PURPOSE DRIVEN.

HELPING BORROWERS.

ENGAGING INVESTORS.

PROMISSORY NOTES FOR ACCREDITED INVESTORS

Call Us Today at

(855) 316-3087

Promissory Note Investment Opportunity in the Refinanced Distressed Private Student Loan Market

Yrefy® ¹ offers eligible accredited investors access to a Regulation D 506(c) private placement promissory note.² This $50,000 minimum³ investment will support Yrefy’s efforts to refinance defaulted private student loans.⁴

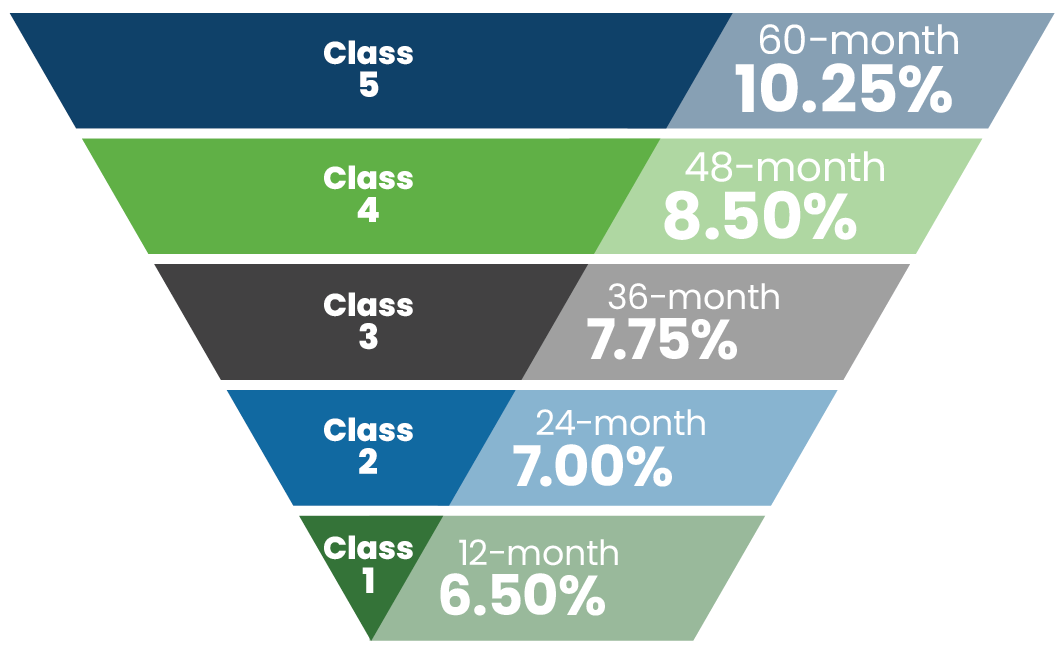

Five Fixed Rate Options and Term Choices: Promissory note classes offer stated annual interest rates of up to 10.25%, depending on the selected term.⁵ Investors can place all or a portion of the initial investment into one or more classes.

Interest Payment Flexibility: Investors may choose to receive monthly interest payments or allow interest to accrue.

Limited Liquidity Feature: Early redemption may be available under certain conditions, and is subject to issuer approval, applicable fees, and the restrictions described in the Private Placement Memorandum (PPM).

By submitting your information on this form, you agree to the terms of our Privacy Policy and our Terms and Conditions.

Investment Class Overview

With five investment classes to choose from—ranging from 12 to 60 months, each class offers flexible features relating to interest payment options, reinvestment, and early withdrawal, as outlined in the PPM.

Every individual class represents a promissory note with its own fixed annual interest rate and maturity date. Investors may allocate their capital across one or more classes. At the maturity of shorter-term investments (Classes 1–4), investors may be able to roll up to longer terms and finish this new longer term at the higher interest rate.⁸

Class 5

5-Year Investment Term;

10.25% Fixed Annual Interest Rate Per Year ⁹

Class 5 offers a 60-month promissory note with a stated annual interest rate of 10.25%, the longest available term in this offering. As with Classes 1-4, investors may elect to receive monthly interest payments or accrue interest through maturity.

Key Features⁶

Possible Monthly Income or Potential Compound Growth

Investors may elect to take potential income monthly or reinvest it into their note, allowing for the investment to compound interest.

Term Flexibility at Maturity

Roll all or a portion of your mature investment(s) into a longer term, and earn a higher interest rate for the duration of that term. See light blue box below.

Liquidity Options

Investors may request to redeem promissory notes before maturity by submitting a written notice or an early withdrawal request through the Investor Portal.⁷

An Investor may elect to invest all or a portion of their investment in the following class(es) of notes for the investment durations listed below, with the corresponding interest rate:

Class 1: 12-month term and a fixed annual interest rate of 6.50% per annum.

Class 2: 24-month term and a fixed annual interest rate of 7.00% per annum.

Class 3: 36-month term and a fixed annual interest rate of 7.75% per annum.

Class 4: 48-month term and a fixed annual interest rate of 8.50% per annum.

Class 5: 60-month term and a fixed annual interest rate of 10.25% per annum.

Each option above (Classes 1, 2, 3, 4, and 5) represents a distinct Term for which the Investor’s Initial Principal Investment Amount and Interest (“Interest”) will remain outstanding until maturity of the note. An Investor may select one or more Classes to invest in. The maximum investment period, including any roll forward, is 60 months (5 years). For example, a 36-month investment may be extended an additional 24 months.

Yrefy Connected to Morningstar® ByAllAccounts®

1 Yrefy SLP4, LLC is a Regulation D 506(c) as filed with the SEC and is for accredited investors only. Please call 855-316-3087 to request the Private Placement Memorandum (PPM), risk disclosures, and other important information about this offering. This offering is not insured by FDIC or SIPC. Yrefy does not give tax or investment advice. Securities are offered through Nobles & Richards, Inc. FINRA member. Yrefy is not affiliated with Nobles & Richards, Inc.

2 These notes are available to accredited investors who do not require immediate liquidity, understand and accept the risks involved, and view this as a part of a broader investment strategy. Investors must acquire the notes for their account and investment purposes only. There is no public market for these notes, and none is expected to develop. These notes are subject to limited liquidity, transfer restrictions, and investors must be able to hold until maturity. This investment carries the risk of total loss. There is no guarantee of income or return of principal. Prospective investors should consult their financial, legal, or tax professionals before investing. Please refer to the PPM for the terms, risks, and limitations.

3 Managers may waive the $50,000 investment minimum for qualified and interested parties at their sole discretion.

4 Investment proceeds will be used for settling and refinancing defaulted private student loans, managing the loan portfolio, funding core operations, key functions, fees, and other business expenses.

5 The stated rate of up to 10.25% represents the highest fixed rate class currently offered for this specific investment opportunity. Actual investor returns may vary based on class selection. There is no guarantee of income or return of principal.

6 Investment fees and expenses include, but are not limited to, offering expenses, costs associated with refinancing private student loans, marketing, operational costs, and other general corporate purposes.

7 The Company may approve, decline, or delay the Early Withdrawal request until such time it determines in its sole discretion, and may have an early redemption penalty. Limited liquidity features are available. See PPM for full explanation of liquidity feature.

8 Roll-up options are subject to the terms in the PPM and any applicable notice requirements.

9 This rate represents only the 5-year term.

10 Please note: any impact on borrowers does not guarantee investment success—review associated risk factors in PPM.

11 While this model is designed to support borrower repayment, investor returns are subject to risk and are not guaranteed. Please refer to the PPM for a full discussion of investment terms, use of proceeds, and associated risks.

12 The portfolio includes loans from multiple borrowers to reduce individual investor risk. Investments are subject to borrower default, market, and liquidity risks. See the PPM for full details.

13 These features do not eliminate investment risk.

14 Default rate data based on internal Yrefy loan performance from 2017–2025 — it has not been independently audited. There is no assurance that this default rate will be sustained in the future.